Understanding Cumulative Interest

What is Cumulative Interest?

Cumulative interest is the total amount of interest earned or charged over time. It represents the sum of all interest accumulated during the entire investment or loan period. For investments, it’s the total interest earned on your principal amount. For loans, it’s the total interest you’ll pay over the loan term.

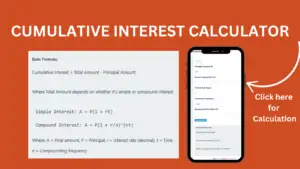

Basic Formula:

Cumulative Interest = Total Amount – Principal Amount

Where Total Amount depends on whether it’s simple or compound interest:

- Simple Interest: A = P(1 + rt)

- Compound Interest: A = P(1 + r/n)^(nt)

Where: A = Final amount, P = Principal, r = Interest rate (decimal), t = Time, n = Compounding frequency

How to Use Cumulative Interest Calculator?

- Choose between Investment or Loan calculator using the tabs

- Enter the principal amount or loan amount

- Input the annual interest rate

- Select the time period

- For investments, choose the compound frequency and adjust for inflation if needed

- Click Calculate to see detailed results and visual representations

Cumulative vs. Compound Interest

While related, these terms refer to different concepts:

| Cumulative Interest | Compound Interest |

|---|---|

| Total interest accumulated over the entire period | Method of calculating interest on prior interest plus principal |

| The end result (total interest earned/paid) | The process of interest earning interest |

| Applies to both simple and compound interest calculations | Specific type of interest calculation method |

Frequently Asked Questions

What factors affect cumulative interest?

Principal amount, interest rate, time period, compounding frequency, and whether you’re making regular deposits or withdrawals all affect the cumulative interest.

Why is the inflation-adjusted value important?

Inflation reduces the purchasing power of money over time. The inflation-adjusted value shows the real worth of your investment in today’s money.

How often should interest be compounded for maximum returns?

Generally, more frequent compounding (daily or monthly) will result in higher returns compared to annual compounding, though the difference may be minimal.

Can I use this calculator for both savings and loans?

Yes! The calculator includes both investment and loan calculations, each optimized for its specific purpose with relevant inputs and results.

How accurate are the inflation adjustments?

The inflation adjustments are based on your input of expected inflation rate. For more accurate long-term planning, consider consulting historical inflation data and economic projections.