In its final policy decision of 2023, the Federal Reserve announced that interest rates would remain unchanged and projected three rate cuts for the following year. This shift in policy reflects the central bank’s determination to address the issue of rapid inflation. After a series of interest rate increases throughout 2022, officials have taken a patient stance, allowing them to assess the impact of these changes on the economy. With signs of slowing inflation and a cooling job market, policymakers believe that the current interest rates are sufficient, with no immediate plans for further increases. This decision marks a significant step in the Fed’s ongoing fight against inflation and its commitment to maintaining stability within the economy moving forward.

This image is property of static01.nytimes.com.

Federal Reserve Meeting

The Federal Reserve recently concluded its final policy decision of 2023, announcing that interest rates will be left unchanged. This decision comes as the central bank prepares for the next phase in its fight against rapid inflation. Additionally, officials have projected that borrowing costs will be cut three times in the coming year. This move signifies the Fed’s shift towards a more cautious and accommodative stance in order to combat rising inflationary pressures.

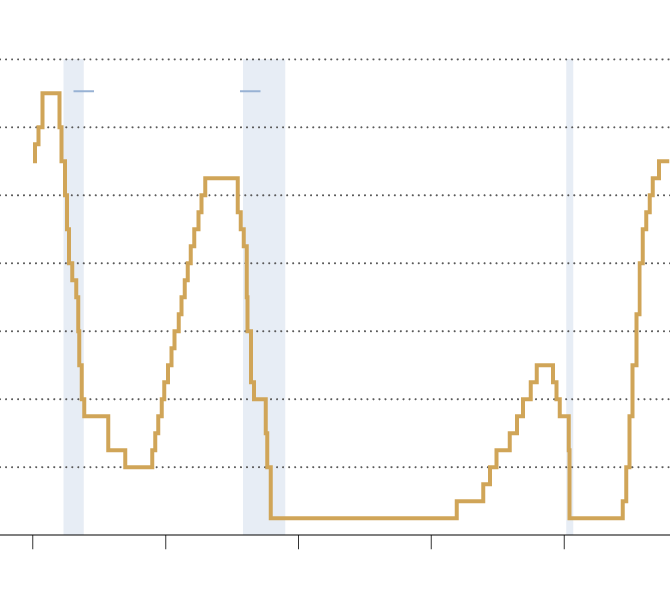

Rates Left Unchanged

In their recent meeting, Federal Reserve policymakers decided to maintain interest rates within a range of 5.25 to 5.5 percent. This decision comes after a period of rapid rate increases that began in March 2022 and led to the highest borrowing costs in 22 years. However, in the past few meetings, officials have chosen to keep rates steady in order to assess the impact on the economy and ensure that inflation will eventually slow to the Fed’s target of 2 percent. The decision to leave rates unchanged reflects their confidence in the current state of the economy.

This image is property of static01.nytimes.com.

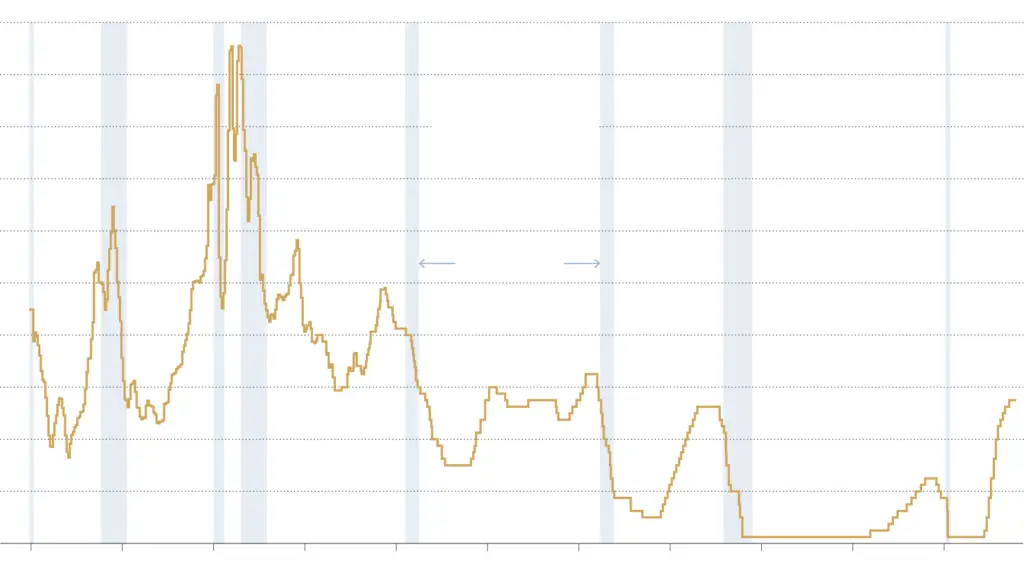

Fed Signals Rate Cuts in 2024

A notable outcome of the Federal Reserve meeting was the projection of three quarter-point rate cuts in the year 2024. This move signals the central bank’s commitment to supporting the economy and maintaining price stability amid fears of rising inflation. The decision to implement rate cuts reflects the Fed’s belief that the current levels of borrowing costs may be hindering economic growth and that a reduction in rates will stimulate spending and investment.

This image is property of static01.nytimes.com.

Stocks Rally

Following the news of the Fed’s decision to leave rates unchanged and signal future rate cuts, the stock market experienced a rally. Investors responded positively to the central bank’s commitment to supporting the economy and the expectation of lower borrowing costs in the future. The rally in stocks reflects the market’s optimism and confidence in the Fed’s ability to manage inflationary pressures while maintaining economic growth.

This image is property of static01.nytimes.com.

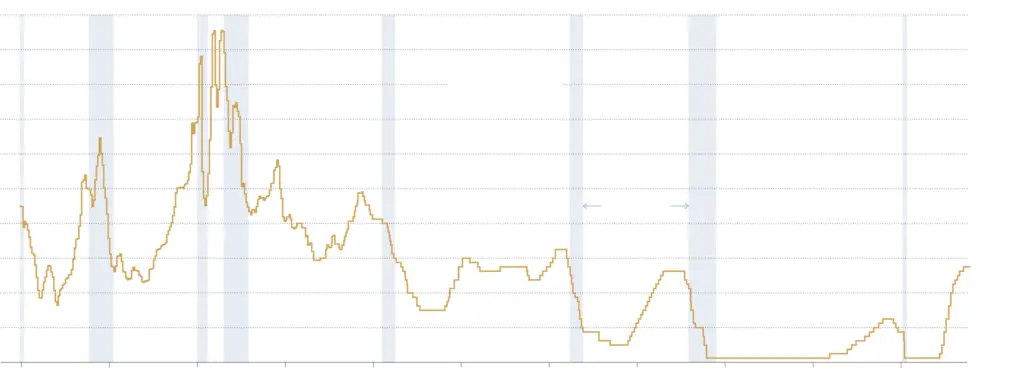

How to Read the Fed’s Projections

Understanding the Federal Reserve’s projections can provide valuable insights into the central bank’s monetary policy decisions. When the Fed releases its projections, it offers guidance on key economic indicators such as interest rates, inflation, and employment. These projections help market participants gauge the future course of the economy and make informed investment decisions.

In the case of interest rates, the Fed’s projections indicate its expectations for changes in borrowing costs over a specific time horizon. This information provides guidance to businesses and individuals on the likely direction of interest rates and helps them make decisions regarding borrowing, investing, and financial planning.

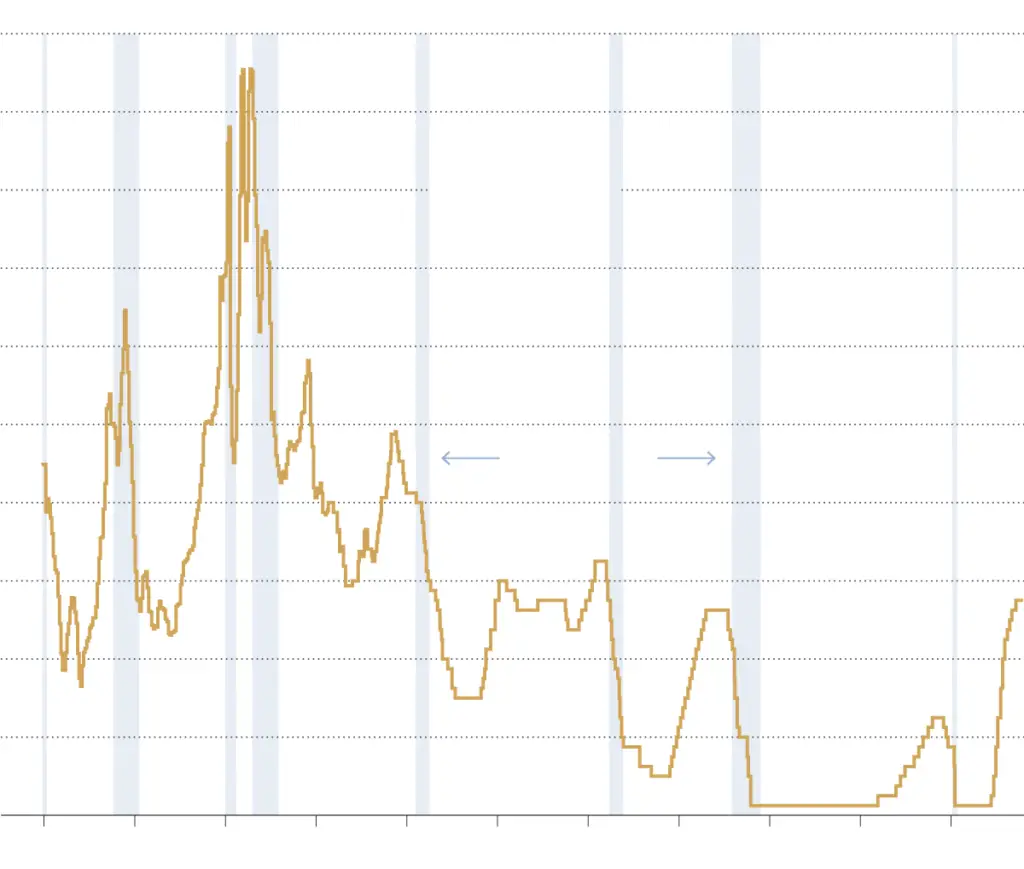

Rate Moves, Explained

Interest rate moves by the Federal Reserve have a significant impact on various aspects of the economy. Understanding the rationale behind these moves is crucial for comprehending their implications.

When the Fed raises interest rates, it aims to slow down economic growth and control inflation. Higher interest rates make borrowing more expensive, reducing consumer spending and business investment. This slowdown helps prevent the economy from overheating and the inflation rate from surpassing the desired target.

On the other hand, when the Fed lowers interest rates, it aims to stimulate economic growth and encourage borrowing and investment. Lower borrowing costs make it more affordable for businesses to expand operations or invest in new projects, while also encouraging individuals to spend and invest. This boost to economic activity can help address issues like low inflation or a struggling job market.

The Fed’s decision regarding interest rates is based on various factors. These include the current state of the economy, inflation levels, employment figures, and global economic trends. By closely monitoring these indicators, the central bank can make informed decisions that support the overall health and stability of the economy.

In conclusion, the Federal Reserve’s recent decision to leave interest rates unchanged and signal future rate cuts reflects its commitment to managing inflation while fostering economic growth. These decisions are based on careful assessments of economic indicators and projections for the future. As investors and market participants, it is crucial to understand the Fed’s actions and projections to make informed decisions regarding our own financial strategies.