In the current economic climate, it’s more important than ever to have a solid financial plan in place. One crucial aspect of that plan is building an emergency fund. An emergency fund is a stash of money that you can rely on in case of unexpected expenses, such as medical bills or job loss. However, according to recent data, a significant number of people don’t have enough savings to cover even a small emergency. In this article, we’ll explore how to build an emergency fund and why it’s essential for your financial security. Whether you’re just starting to save or need to boost your existing emergency fund, we’ll provide practical tips to help you get started.

Read more articles:

- Student Loan Forgiveness: What You Need To Know

- What Is YAHOO FINANCE

- Yahoo Finance API – A Complete Guide

What is an emergency fund?

An emergency fund is a savings account that you set aside for unexpected expenses or financial emergencies. It’s typically recommended to have enough money in your emergency fund to cover at least three to six months’ worth of living expenses. This can include things like unexpected medical bills, car repairs, home repairs, or sudden job loss. The purpose of an emergency fund is to provide a financial cushion and peace of mind in case something unexpected happens that could otherwise cause financial hardship. By having an emergency fund, you can avoid having to rely on credit cards or loans, which can lead to long-term debt and financial stress.

Explain with a Practical example:

Let’s say you have a steady job and are able to pay your bills each month. You have a certain amount of money left over after your expenses, which you decide to set aside in an emergency fund. Over time, you build up a savings account with several months’ worth of living expenses.

Now, let’s say your car breaks down and needs a costly repair. Normally, this would be a stressful situation that might force you to take on debt or delay paying other bills. However, because you have an emergency fund, you’re able to pay for the repair without dipping into your regular income or taking on additional debt. This provides peace of mind and helps you avoid financial stress.

Or, imagine you lose your job unexpectedly. Without an emergency fund, you might struggle to make ends meet while you search for a new job. But with an emergency fund, you have a financial cushion that can cover your expenses while you look for new employment.

In both cases, an emergency fund provides a safety net that can help you navigate unexpected financial challenges without having to resort to credit cards or loans.

Why do I need an emergency fund?

Here are some key reasons why you need an emergency fund:

- To cover unexpected expenses: Unexpected expenses can arise at any time, and they can be costly. An emergency fund provides a financial cushion to help you cover these expenses without going into debt or sacrificing your regular expenses. For example, if your refrigerator breaks down and you need to buy a new one, your emergency fund can cover the cost.

- To cope with job loss: Losing your job can be a significant financial setback. With an emergency fund, you can cover your expenses while you look for new employment. For example, if you get laid off from your job, your emergency fund can help cover your rent, utilities, and other essential expenses until you find a new job.

- To avoid high-interest debt: If you don’t have an emergency fund, you may be forced to rely on high-interest credit cards or loans to cover unexpected expenses. This can lead to long-term debt and financial stress. For example, if your car breaks down and you don’t have an emergency fund to cover the repairs, you may have to put the cost on a credit card with a high-interest rate.

- To provide peace of mind: Financial stress can take a toll on your mental health and well-being. By having an emergency fund, you can have peace of mind knowing that you have a safety net to help you through unexpected financial challenges.

Real-life example:

Let’s say you have an emergency fund and you get into a car accident. Your car needs repairs, but you don’t have enough money to cover the cost. Because you have an emergency fund, you’re able to pay for the repairs without having to rely on credit cards or loans. This helps you avoid debt and financial stress, and you’re able to get back on the road quickly.

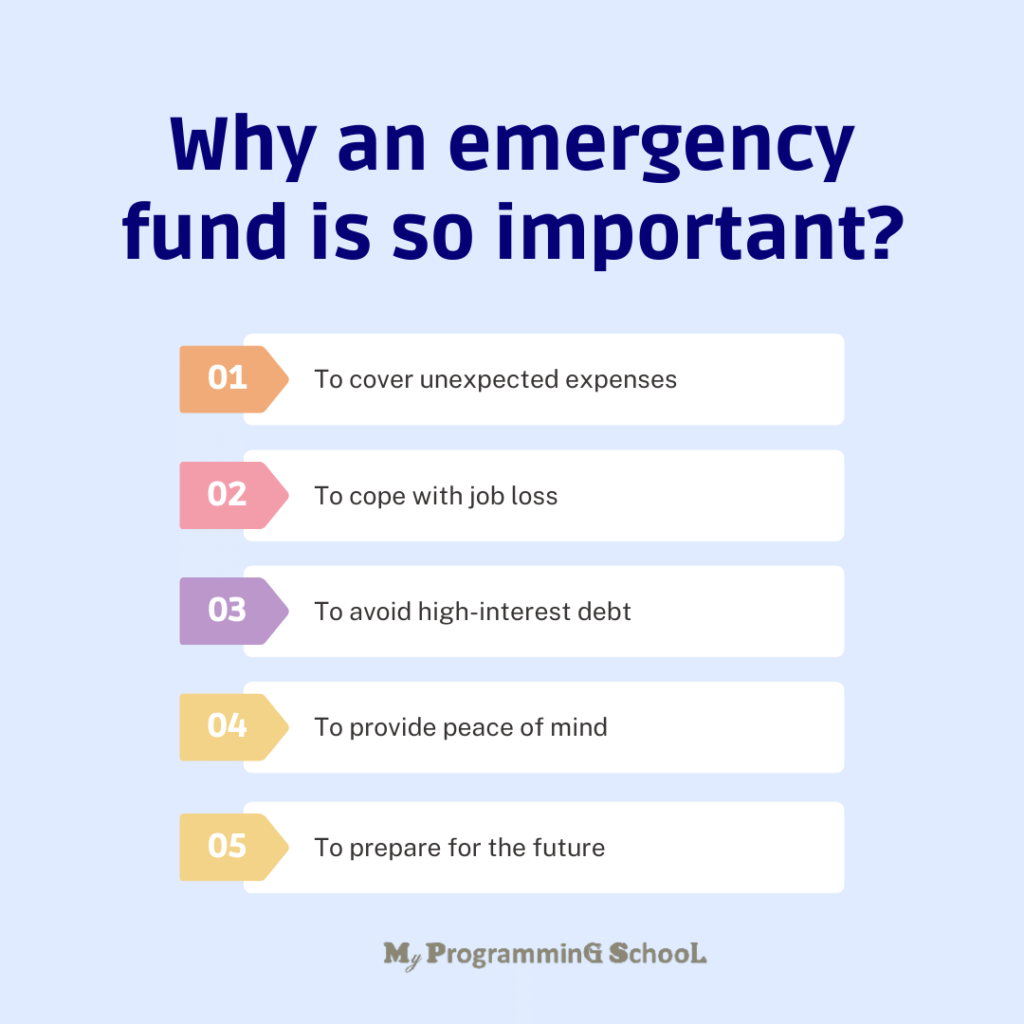

Why an emergency fund is so important?

Here are some key reasons why an emergency fund is so important:

- To cover unexpected expenses: Unexpected expenses can arise at any time, and they can be costly. Having an emergency fund provides a financial cushion to help you cover these expenses without going into debt or sacrificing your regular expenses. For example, if your pet gets sick and needs expensive medical treatment, your emergency fund can cover the cost.

- To cope with job loss: Losing your job can be a significant financial setback. With an emergency fund, you can cover your expenses while you look for new employment. For example, if you get laid off from your job, your emergency fund can help cover your rent, utilities, and other essential expenses until you find a new job.

- To avoid high-interest debt: If you don’t have an emergency fund, you may be forced to rely on high-interest credit cards or loans to cover unexpected expenses. This can lead to long-term debt and financial stress. For example, if your car breaks down and you don’t have an emergency fund to cover the repairs, you may have to put the cost on a credit card with a high-interest rate.

- To provide peace of mind: Financial stress can take a toll on your mental health and well-being. By having an emergency fund, you can have peace of mind knowing that you have a safety net to help you through unexpected financial challenges.

- To prepare for the future: Building an emergency fund is an important part of long-term financial planning. By having an emergency fund, you can be better prepared for unexpected expenses or changes in your income. This can help you achieve your financial goals over time.

Real-life example:

Let’s say you have an emergency fund and you lose your job. With your emergency fund, you’re able to cover your expenses while you look for new employment. This helps you avoid falling behind on bills or going into debt. Eventually, you find a new job and are able to rebuild your savings. Without your emergency fund, you may have had to rely on credit cards or loans to cover your expenses, which could have led to long-term debt and financial stress.

How much should I have in my emergency fund?

The amount you should have in your emergency fund can vary depending on your personal circumstances, such as your income, expenses, and job security. However, as a general rule of thumb, most financial experts recommend having at least three to six months’ worth of living expenses in your emergency fund.

Having this amount in your emergency fund can help ensure that you have enough money to cover unexpected expenses or job loss for a few months without having to rely on credit cards or loans.

It’s also important to note that your emergency fund should be easily accessible, such as in a savings account or money market account, so that you can quickly access the funds when needed. You may also want to consider keeping your emergency fund in a separate account from your regular savings or checking account to help avoid spending the money on non-emergency expenses.

Of course, the amount you need in your emergency fund can vary based on your individual circumstances, such as if you have dependents or if you work in an industry with higher job insecurity. It’s important to assess your own situation and determine how much you need to feel financially secure. You can also consider working with a financial advisor to help determine the appropriate amount for your emergency fund.

How do I build an emergency fund?

Here are some steps you can take to build an emergency fund:

- Set a savings goal: Determine how much you want to save for your emergency fund. As a general rule of thumb, aim to save at least three to six months’ worth of living expenses.

- Start small: If you don’t have much extra money each month, start by setting aside a small amount each week or month. Even if it’s just a few dollars, it’s a start!

- Create a budget: Creating a budget can help you identify areas where you can cut back on expenses to save more money. Look for ways to reduce your expenses, such as eating out less, canceling subscriptions you don’t use, or finding cheaper alternatives for things you regularly purchase.

- Set up automatic transfers: Consider setting up automatic transfers from your checking account to your emergency fund savings account. This can help ensure that you consistently save money each month.

- Increase savings over time: As you become more comfortable with saving, try to increase the amount you save each month. Set new savings goals and challenge yourself to save more.

Real-life example:

Let’s say you want to save $5,000 for your emergency fund. You decide to start by setting aside $50 from each paycheck. You also create a budget and identify areas where you can reduce your expenses, such as canceling a gym membership you don’t use. After a few months, you increase your savings to $100 from each paycheck. Eventually, you reach your savings goal of $5,000 and feel more financially secure knowing that you have a safety net to help you through unexpected expenses.

What Will You Need?

To build an emergency fund, you will need a few key things:

- A savings account: You’ll need a place to store your emergency fund. Look for a savings account or money market account with a competitive interest rate and no monthly fees. This will help your money grow over time and avoid fees that could eat into your savings.

- A budget: Creating a budget can help you identify areas where you can cut back on expenses and save more money. This can be done using a spreadsheet or budgeting app, and should include all of your income and expenses.

- A savings goal: Determine how much you want to save for your emergency fund. As a general rule of thumb, aim to save at least three to six months’ worth of living expenses.

- Patience and discipline: Building an emergency fund takes time and discipline. It can be tempting to dip into your savings for non-emergency expenses, but it’s important to stay committed to your savings goal.

- Consistent savings habits: To build an emergency fund, you’ll need to consistently save money over time. Consider setting up automatic transfers from your checking account to your emergency fund savings account to make this process easier.

- Flexibility: Unexpected expenses can arise at any time, so it’s important to be flexible and adjust your savings goals or budget as needed.

Overall, building an emergency fund requires a combination of financial tools, discipline, and a long-term mindset. By staying committed to your savings goals and making smart financial decisions, you can build a financial safety net that can help you weather unexpected financial challenges.

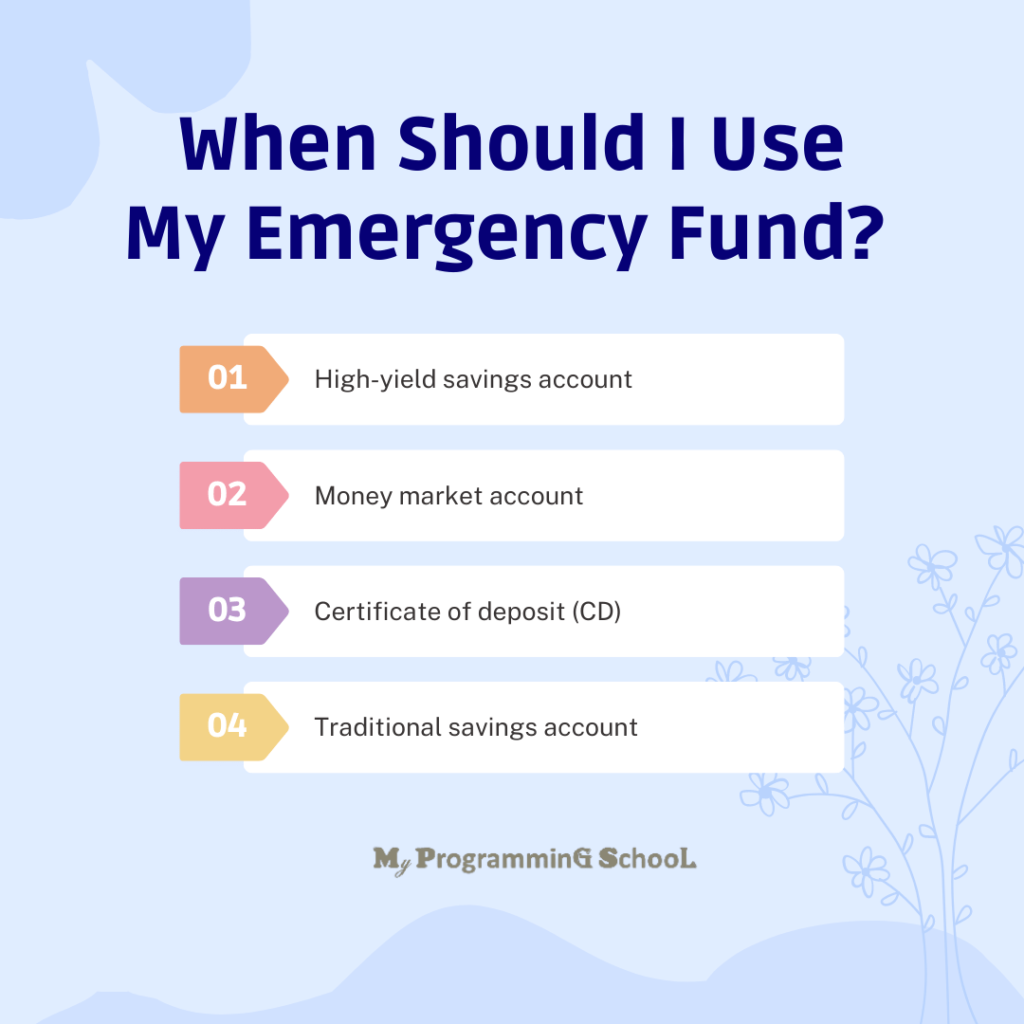

Where to keep your emergency fund?

When it comes to keeping your emergency fund, it’s important to choose a safe and easily accessible location. Here are some options to consider:

- High-yield savings account: A high-yield savings account is a type of savings account that typically offers a higher interest rate than a traditional savings account. This can help your emergency fund grow over time while keeping your money easily accessible. Examples of banks that offer high-yield savings accounts include Ally Bank, Marcus by Goldman Sachs, and Discover.

- Money market account: A money market account is similar to a savings account but typically offers a higher interest rate. Money market accounts may have some restrictions, such as limits on the number of withdrawals or minimum balance requirements. Examples of banks that offer money market accounts include Capital One, CIT Bank, and Synchrony Bank.

- Certificate of deposit (CD): A certificate of deposit is a type of savings account that typically offers a higher interest rate in exchange for locking up your money for a set period of time. CDs typically have early withdrawal penalties, so they may not be the best option for an emergency fund that you need quick access to. However, if you have a larger emergency fund or are willing to stagger CDs with different maturity dates, this could be an option. Examples of banks that offer CDs include Barclays, Wells Fargo, and Chase.

- Traditional savings account: While traditional savings accounts typically offer lower interest rates than high-yield savings accounts or money market accounts, they are still a safe and easily accessible option for your emergency fund. Examples of banks that offer savings accounts include Bank of America, Chase, and Wells Fargo.

Ultimately, the best option for where to keep your emergency fund will depend on your individual needs and preferences. It’s important to consider factors such as interest rates, accessibility, and any restrictions or fees associated with the account before making a decision.

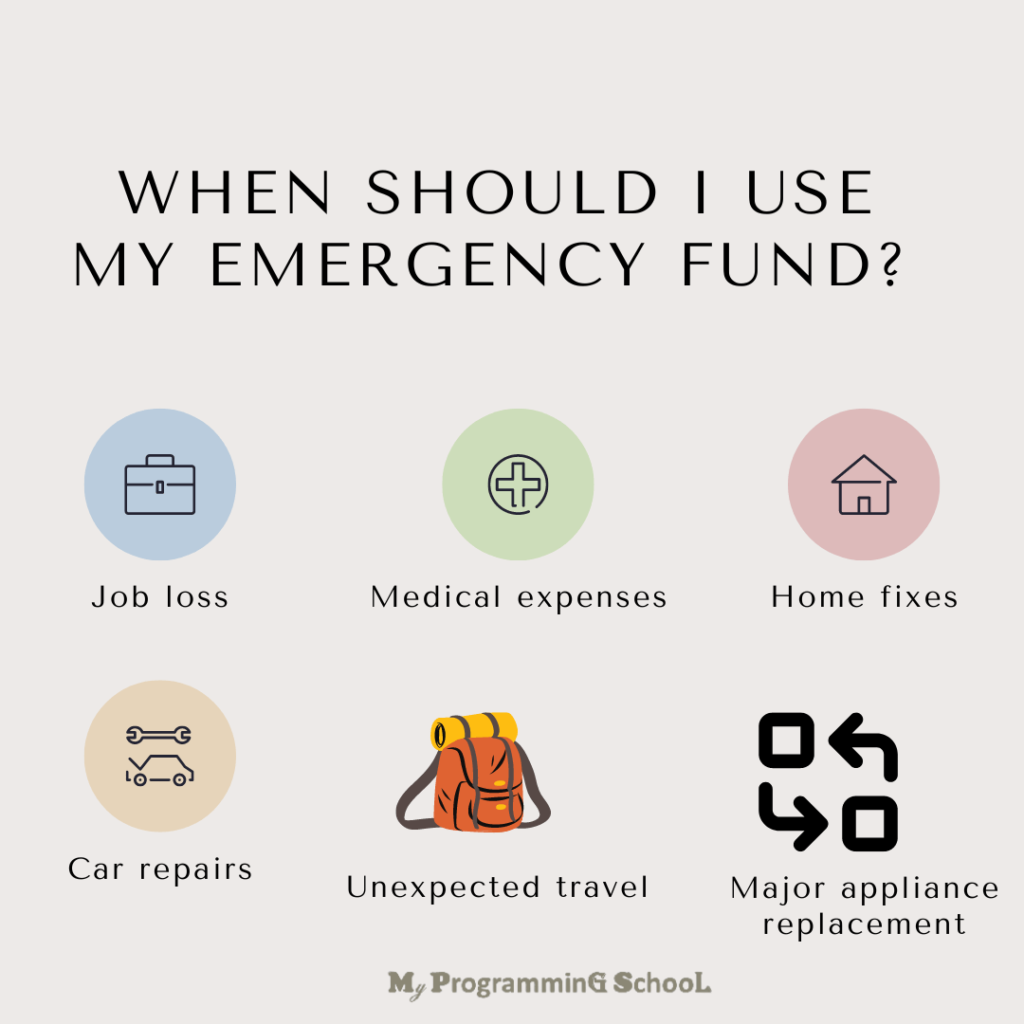

When Should I Use My Emergency Fund?

Your emergency fund should be reserved for unexpected and necessary expenses that you cannot afford to pay for with your regular income. Here are some examples of when you might want to use your emergency fund:

- Job loss: If you lose your job, your emergency fund can help cover your living expenses until you are able to find a new job.

- Medical expenses: If you have an unexpected medical expense that is not covered by insurance, your emergency fund can help cover the cost.

- Car repairs: If your car breaks down and requires expensive repairs, your emergency fund can help cover the cost and prevent you from going into debt.

- Home repairs: If your home requires urgent repairs, such as a leaking roof or a broken furnace, your emergency fund can help cover the cost.

- Unexpected travel: If you need to travel unexpectedly for a family emergency or other urgent situation, your emergency fund can help cover the cost of travel and accommodations.

- Major appliance replacement: If one of your major appliances, such as your refrigerator or washing machine, breaks down and needs to be replaced, your emergency fund can help cover the cost.

It’s important to remember that your emergency fund should be used only for true emergencies, and not for discretionary or non-essential expenses. If you do need to use your emergency fund, be sure to replenish it as soon as possible to ensure that you are prepared for any future unexpected expenses.

How much to save in your emergency fund?

The amount you should save in your emergency fund depends on your individual circumstances, such as your monthly expenses, income, and financial goals. However, a general rule of thumb is to save enough to cover three to six months’ worth of living expenses.

To calculate your ideal emergency fund amount, add up your monthly expenses, including rent or mortgage payments, utilities, food, transportation, insurance, and any other necessary expenses. Multiply this amount by three to six to determine your target emergency fund amount.

If you have dependents, own a home, or have variable income, you may want to aim for a larger emergency fund, such as six to twelve months’ worth of living expenses.

It’s important to note that the size of your emergency fund may change over time, as your expenses or income level changes. You should periodically review your emergency fund and adjust it as needed.

Ultimately, the goal of an emergency fund is to provide you with a financial safety net in case of unexpected events, such as job loss, medical expenses, or a major home repair. By having an adequate emergency fund in place, you can have peace of mind knowing that you are prepared for whatever life throws your way.

7 easy steps to get your emergency fund started

here are 7 easy steps to get your emergency fund started:

- Set a goal: Determine how much money you want to save in your emergency fund. As mentioned earlier, a good starting point is three to six months’ worth of living expenses.

- Evaluate your expenses: Review your monthly expenses and determine areas where you can cut back to free up extra money to put towards your emergency fund. This might include reducing your dining out budget, canceling unused subscriptions, or downsizing your living situation.

- Start small: Don’t try to save your entire emergency fund all at once. Start small by setting a monthly savings goal that is achievable based on your current income and expenses. For example, you might start by saving $50 per month and gradually increase the amount as you are able to.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund savings account each month. This way, you won’t have to remember to manually transfer the money and you’ll be less likely to spend it on other expenses.

- Choose a separate savings account: Open a separate savings account specifically for your emergency fund. This will help you track your progress toward your savings goal and make it less tempting to dip into the funds for other expenses.

- Review and adjust: Regularly review your emergency fund savings progress and adjust your savings goals or monthly contributions as needed. This might include increasing your monthly contribution if you receive a raise or decreasing it temporarily if unexpected expenses arise.

- Replenish your fund: If you need to use your emergency fund for an unexpected expense, be sure to replenish the funds as soon as possible to ensure that you are prepared for any future emergencies.

Example:

Let’s say your monthly expenses are $3,000. Your goal is to save six months’ worth of living expenses, which would be $18,000. Based on your current income and expenses, you decide to start by saving $100 per month toward your emergency fund. You open a separate high-yield savings account and set up an automatic transfer from your checking account to your emergency fund savings account each month. After three months, you have saved $300 towards your emergency fund. You review your budget and determine that you can increase your monthly contribution to $150. After a year, you have saved $1,800 towards your emergency fund and feel more confident in your ability to handle unexpected expenses.

Tips to help you build your buffer

here are some tips to help you build your emergency fund:

- Start small: If you’re just starting to build your emergency fund, don’t worry if you can’t save a lot of money right away. Even saving a few dollars each week can add up over time. Start by saving what you can, and gradually increase your savings as you are able to.

- Cut back on unnecessary expenses: Look at your monthly expenses and identify areas where you can cut back. Canceling subscriptions, reducing your dining out budget, and finding ways to reduce your utility bills can all help you save money that you can put toward your emergency fund.

- Use windfalls to your advantage: When you receive unexpected income, such as a tax refund or bonus at work, consider putting a portion of it towards your emergency fund. This can help you build your savings more quickly.

- Set up automatic transfers: Automating your savings can make it easier to build your emergency fund. Set up automatic transfers from your checking account to your savings account each month. This ensures that a portion of your income goes directly into your emergency fund without you having to remember to make the transfer.

- Consider a side hustle: If you’re struggling to find money to save each month, consider starting a side hustle to earn extra income. This can be anything from freelance work to selling items online. The extra income can help you build your emergency fund more quickly.

- Keep your emergency fund separate: To avoid spending your emergency fund on non-emergency expenses, keep it separate from your other savings accounts. Consider opening a separate savings account specifically for your emergency fund.

- Make saving a priority: Building your emergency fund requires discipline and commitment. Make saving a priority by setting goals, tracking your progress, and celebrating your successes along the way.

Example:

Let’s say you want to build an emergency fund with a goal of $5,000. You start by reviewing your monthly expenses and identifying areas where you can cut back. You cancel a few subscriptions, reduce your dining-out budget, and find ways to lower your utility bills. You also start a side hustle selling handmade crafts online, which brings in an extra $200 per month. You set up automatic transfers of $100 per month from your checking account to your new high-yield savings account specifically for your emergency fund. A few months later, you receive a bonus at work and decide to put $500 toward your emergency fund. After a year, you have saved $2,500 towards your emergency fund and feel more prepared for unexpected expenses. You celebrate your progress and continue to make saving a priority.

Quick Ways to Start Your Emergency Fund

here are some quick ways to start your emergency fund:

- Sell unused items: Go through your closet, garage, and storage spaces and gather any items that you no longer need or use. Sell these items online or at a yard sale and put the money directly into your emergency fund.

- Cut back on daily expenses: Small daily expenses can add up quickly. Consider cutting back on your coffee or lunch out budget and put the savings into your emergency fund.

- Use cashback apps: Cashback apps like Ibotta and Rakuten can help you save money on purchases you’re already making. When you receive cashback, put it directly into your emergency fund.

- Pick up a side hustle: Consider picking up a side hustle, such as dog walking or freelance writing, to earn extra income. Put all of your earnings from your side hustle directly into your emergency fund.

- Use your tax refund: If you receive a tax refund each year, put a portion or all of it directly into your emergency fund.

- Participate in a savings challenge: Savings challenges, such as the 52-Week Money Challenge or the $5 Bill Savings Challenge, can help you build your emergency fund quickly. These challenges encourage you to save small amounts of money each week, which can add up over time.

Example:

Let’s say you need to start your emergency fund quickly and don’t have a lot of extra money to work with. You decide to go through your closet and garage and gather items that you no longer use. You sell these items online and make $200. You also decide to cut back on your daily expenses by bringing your lunch to work instead of eating out. This saves you an additional $50 per week. You participate in the 52-Week Money Challenge and save $1 per week, which adds up to $1,378 by the end of the year. In total, you’ve saved $3,778 towards your emergency fund in just one year by using quick and easy methods. You feel more secure knowing that you have some savings in case of unexpected expenses.

FAQ:

What is an emergency fund and why do I need one?

1. A savings account for unexpected expenses

2. Protects you from financial hardshipHow much money should I have in my emergency fund?

3-6 months of living expenses

How do I start building an emergency fund if I have no savings?

Start small, make a budget, set a savings goal

How do I prioritize building an emergency fund versus paying off debt?

Prioritize high-interest debt, contribute to both simultaneously

What are some quick ways to start building an emergency fund?

Sell unused items, cut back on daily expenses, use cashback apps, pick up a side hustle, use your tax refund, participate in a savings challenge

Where should I keep my emergency fund?

High-yield savings account, money market account, or certificate of deposit

When should I dip into my emergency fund?

For true emergencies only, such as unexpected medical expenses or job loss

How often should I contribute to my emergency fund?

Regularly, even if it’s a small amount

Can I invest my emergency fund?

It’s generally not recommended to invest emergency funds due to potential loss of value and lack of accessibility

How do I maintain my emergency fund once it’s established?

Review and adjust your budget regularly, continue to contribute regularly, and only use for true emergencies.

Conclusion: Building an emergency fund

Building an emergency fund is an essential step toward securing your financial future. It requires discipline, commitment, and a solid financial plan to ensure you’re prepared for unexpected expenses or events that can impact your financial stability. By following the steps outlined in this guide, you can establish a solid emergency fund that will provide peace of mind and help you weather any financial storm that may come your way. Remember, every little bit helps, so start small and be consistent, and you’ll be well on your way to building a healthy emergency fund.

This article is taken suggestions from different websites like Securian Financial, consumerfinance.gov, and more.