As the holiday season approaches, retailers can’t help but feel a sense of apprehension about the mood of shoppers. Despite the fact that consumer spending has remained strong in 2023, thanks to the resiliency of individuals and the economy as a whole, there are a few factors that may lead shoppers to exercise a bit more caution this year. With high costs of food, mortgage payments, and the resumption of federal student loan payments weighing on their minds, consumers might think twice before splurging. However, there is still hope for retailers, as the National Retail Federation predicts a 3 to 4 percent increase in holiday sales compared to last year. The recent Amazon Prime Day also showed a slight increase in consumer spending, providing a glimmer of optimism amid the uncertainties. While the decline in retail sales in October was smaller than expected, it is anticipated that holiday sales will be decent but not as robust as in previous years. With factors such as slower wage growth and increased unemployment potentially impacting consumer spending, the holiday shopping landscape is filled with varied approaches. Some shoppers plan meticulously and budget accordingly, while others embrace the spirit of the season and spend freely. One thing is for sure: everyone is on the lookout for the best deals and discounts to make their holiday shopping experience a little easier on the wallet.

This image is property of static01.nyt.com.

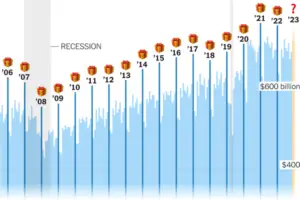

Consumer spending trends

Retailers concerned about shopper mood

Retailers are expressing concerns about the mood of shoppers during this holiday season. Despite consumer spending remaining strong in 2023, retailers are picking up on a sense of caution among consumers. They are worried that this cautious mood may affect sales during the holiday season. Retailers understand that the overall sentiment of shoppers plays a significant role in driving sales, and they are closely monitoring consumer behavior and preferences to adjust their strategies accordingly.

Strong consumer spending in 2023

Despite the concerns expressed by retailers, consumer spending has remained strong throughout 2023. Despite higher prices and reduced savings, consumers have continued to spend their hard-earned money. This sustained spending is indicative of the resilience of consumers and their willingness to invest in products and experiences they deem essential and valuable.

Cautious shoppers due to high costs

The high cost of living has led to more cautious shoppers in recent times. Rising prices of essentials such as food and mortgage payments, coupled with the resumption of federal student loan payments, have made consumers more mindful of their spending. They are carefully considering their purchases and focusing on items that provide the most value.

Impact of federal student loan payments

The resumption of federal student loan payments has had a significant impact on consumer spending. Many individuals have had to readjust their budgets to accommodate these monthly payments. This has resulted in a more conscious approach to spending, as consumers strive to strike a balance between necessary expenses and discretionary purchases.

Holiday sales predictions

National Retail Federation’s predictions

The National Retail Federation has predicted a 3 to 4 percent increase in holiday sales compared to the previous year. This forecast provides a level of optimism for retailers, who are hoping for a strong end to the year. The NRF’s predictions take into account various factors such as consumer sentiment, economic indicators, and historical patterns to provide an informed outlook on holiday sales.

Slight increase in spending during Prime Day

Amazon’s Prime Day, a highly anticipated event for both shoppers and retailers, showed a slight increase in consumer spending. This signals that consumers are still willing to spend during targeted sales and promotional events. While the increase may not have been significant, it provides an encouraging glimpse into consumer behavior leading up to the holiday season.

Retail sales decline in October

Retail sales experienced a slight decline of 0.1 percent in October, although the decline was smaller than expected. Despite this slight setback, retailers are hopeful that sales will rebound during the holiday season. They are actively working on engaging consumers and creating enticing offers to incentivize spending.

Decent but not strong holiday sales

While retailers are cautiously optimistic about holiday sales, expectations are tempered compared to previous years. The anticipation is for decent sales, but not at the same level as seen in more robust economic periods. Factors such as higher prices, cautious consumers, and economic uncertainties contribute to the more conservative outlook for holiday sales.

This image is property of static01.nyt.com.

Income disparity and its effect

Higher-income shoppers and their savings

Higher-income shoppers tend to have more savings and disposable income, allowing them to weather economic fluctuations more comfortably. They have a greater capacity to spend during the holiday season and may be less influenced by concerns about rising costs. These shoppers may opt for more luxurious purchases or invest in experiences that align with their lifestyle.

Lower-income shoppers struggling to afford

On the other hand, lower-income shoppers often struggle to afford holiday shopping due to the high cost of living and limited disposable income. With a smaller financial cushion, these shoppers face greater challenges in allocating funds for holiday-related expenses. They may need to prioritize essential spending and may not have the same financial flexibility as higher-income counterparts.

Impact of slower wage growth

Slower wage growth has a direct impact on consumer spending, particularly for lower-income individuals. When wages do not keep up with the rising cost of living, consumers have less purchasing power. This can lead to a decrease in overall spending during the holiday season, as individuals prioritize meeting basic needs over discretionary purchases.

Increased unemployment affecting spending

High levels of unemployment or job insecurity can significantly impact consumer spending. When individuals are uncertain about their employment status or face job loss, they tend to cut back on non-essential expenses, including holiday shopping. The fear of an uncertain financial future can overshadow the joy of the holiday season, leading to reduced spending among those directly affected by unemployment.

Consumer behavior during holiday shopping

Seeking deals and discounts

Many consumers eagerly look for deals, discounts, and promotions during the holiday season. They see this time of year as an opportunity to maximize their purchasing power and save money on desired items. Bargain-hunting becomes a popular activity, as shoppers actively search for the best prices and take advantage of limited-time offers.

Different approaches to holiday shopping

Different shoppers have various approaches to holiday shopping. Some individuals plan and budget meticulously, keeping track of expenses and limiting their purchases to stay within their means. They create detailed shopping lists and research the best deals to make the most out of their holiday shopping experience. Others, however, take a more spontaneous approach, allowing themselves to indulge in impulsive purchases without strict budgetary constraints.

Some shoppers planning and budgeting

For those who plan and budget, holiday shopping involves strategic decision-making and careful consideration of priorities. These shoppers understand the importance of setting financial boundaries and avoid getting caught up in the frenzy of excessive spending. They aim for a balance between gift-giving and maintaining a sensible financial position.

Others spending freely

On the other end of the spectrum, some shoppers approach holiday shopping with a more carefree attitude. They prioritize the experience of spontaneous purchases and enjoy the thrill of finding unexpected treasures. While they may not adhere strictly to a budget, these shoppers are still conscious of their financial limitations and aim to avoid excessive debt.

In conclusion, the holiday season brings forth a variety of consumer spending trends. Retailers are monitoring shopper mood with concern, and despite a strong overall consumer spending in 2023, cautiousness persists due to high costs and the impact of federal student loan payments. Holiday sales predictions from the National Retail Federation provide some optimism, but retail sales experienced a decline in October. Income disparity affects how consumers approach holiday shopping, with higher-income shoppers having more savings and lower-income shoppers facing affordability challenges. Finally, consumer behavior during holiday shopping varies, with some seeking deals and discounts while others plan and budget or spend freely. Understanding these trends can help both retailers and consumers navigate the holiday season successfully.

Source: https://www.nytimes.com/2023/11/23/business/economy/black-friday-shopping.html