The stock market is a complex and often confusing place, with thousands of companies trading shares and billions of dollars changing hands every day. One of the most talked-about events in recent times has been the GameStop phenomenon, which saw the video game retailer’s stock price surge to extraordinary levels. Yahoo Finance, one of the most popular financial websites in the world, was at the forefront of reporting on the story. In this article, we will explore the impact of GameStop on the stock market, and how Yahoo Finance covered the story.

Yahoo Finance API – A Complete Guide

Table of Contents

- Introduction

- The Rise of GameStop

- The Role of Reddit and Social Media

- The Short Squeeze

- The Fallout

- Yahoo Finance’s Coverage of GME

- The Future of the Stock Market

- Conclusion

- FAQs

Introduction

The GameStop saga began in late 2020 when a group of amateur investors on Reddit’s WallStreetBets community noticed that several large hedge funds had taken massive short positions on GameStop’s stock. The Redditors saw an opportunity to drive up the stock price by buying shares and causing a short squeeze, where the hedge funds would be forced to cover their short positions at a loss. The plan worked, and GameStop’s stock price soared from around $20 in early January to a high of $347 in late January.

The Rise of GameStop

GameStop, a video game retailer with around 5,000 stores worldwide, had been struggling for years due to the shift to digital downloads and the COVID-19 pandemic. The company’s stock price had been in decline since 2015, with many analysts predicting its demise. However, the Redditors on WallStreetBets saw something different. They believed that GameStop’s stock was undervalued and that the company had a bright future.

The Role of Reddit and Social Media

Reddit’s WallStreetBets community was instrumental in driving up GameStop’s stock price. The subreddit had around 2 million members at the time of the GameStop saga, with many of them amateur investors who saw an opportunity to take on the Wall Street establishment. The Redditors used social media to spread the word about their plan, and soon the mainstream media picked up on the story.

The Short Squeeze

The short squeeze was the key factor that drove up GameStop’s stock price. When a company’s stock is heavily shorted, it means that many investors have bet against it, hoping that the price will fall. However, if the stock price starts to rise, the short sellers may be forced to buy back the shares at a higher price to cover their losses. This creates a feedback loop, with buying pressure driving up the price even further.

The Fallout

The GameStop saga had far-reaching consequences. Several hedge funds lost billions of dollars as a result of the short squeeze, and some even had to be bailed out by other investors. The Redditors who had bought GameStop’s stock saw massive gains, with some turning small investments into millions of dollars. The story also sparked a national conversation about the power of social media and the role of individual investors in the stock market.

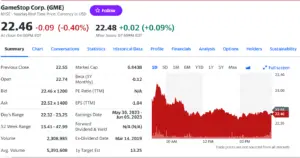

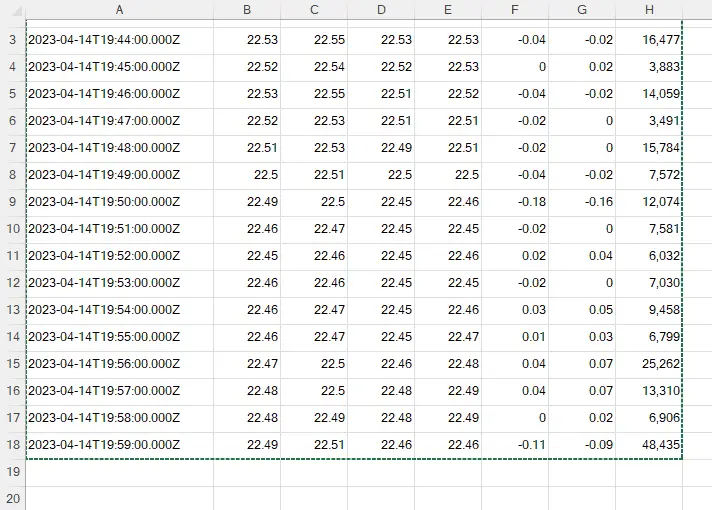

Yahoo Finance’s Coverage of GME

Yahoo Finance was one of the leading sources of news and analysis on the GameStop saga. The website provided real-time stock quotes, charts, and news articles on GameStop’s stock price and the wider implications of the story. Yahoo Finance also featured interviews with experts and individual investors who had profited from the short squeeze.

The Future of the Stock Market

The GameStop saga has raised many questions about the future of the stock market. Some experts believe that the episode was a one-off event and that the market will return to business as usual. Others argue that the rise of social media and individual investors means that the balance of power is shifting away from Wall Street and towards Main Street. Whatever the future holds, it is clear that the GameStop saga has exposed some of the weaknesses and inequalities in the stock market.

Conclusion

The GameStop saga was a fascinating and highly unusual event that captured the world’s attention. It demonstrated the power of social media and individual investors and raised important questions about the fairness and transparency of the stock market. Yahoo Finance played a crucial role in covering the story, providing real-time updates and expert analysis. The future of the stock market is uncertain, but one thing is clear – the GameStop saga will go down in history as one of the most significant events in the world of finance.

FAQs: Yahoo Finance GME

Did GameStop’s stock price ever return to its pre-saga levels?

GameStop’s stock price did eventually return to more normal levels after the height of the saga in January 2021. However, the stock is still trading at a much higher level than it was before the saga began.

What were the consequences of the GameStop saga for individual investors?

The GameStop saga showed that individual investors can have a significant impact on the stock market, even when they are up against powerful institutional investors. It also raised questions about the fairness and transparency of the stock market and sparked a debate about whether the rules need to be changed to level the playing field for all investors.

How did the mainstream media react to the story?

The mainstream media was initially slow to pick up on the story, but once it gained momentum, it received extensive coverage across all major news outlets. Many commentators were fascinated by the power of social media and the potential for individual investors to challenge the traditional players in the stock market.

Is short selling a legitimate practice in the stock market?

Yes, short selling is a legitimate practice in the stock market. It is a way for investors to profit from a decline in the price of a stock, and it is used by many professional investors to manage risk and generate returns. However, short selling can also be risky and can sometimes lead to market volatility.

Will the GameStop saga lead to any regulatory changes in the stock market?

It is too early to say whether the GameStop saga will lead to any regulatory changes in the stock market. However, it has sparked a debate about whether the rules need to be changed to ensure that the market is fair and transparent for all investors, and it is possible that regulators will take action in response to the events of January 2021.